Citizens Advice sounds the alarm on £280 car insurance ethnicity penalty

Citizens Advice has uncovered a shocking trend of people of colour paying hundreds of pounds a year more for their car insurance than white people.

As part of a year-long investigation, the charity analysed 18,000 car insurance costs reported by people who came to Citizens Advice for debt help in 2021. It found that, on average, people of colour paid £250 a year more than white people.

The second part of the research shone a spotlight on eight postcodes, to compare areas where there is a high white population to areas where there is a high proportion of people of colour. It found people living in the areas where there’s a high proportion of people of colour paid at least £280 more for their car insurance.

Everyone who lives in the postcode pays the higher prices, regardless of their ethnicity. But if this trend were to be replicated across the country, people of colour would be 13 times more likely to be paying it than white people. And so could be paying at least £213 million a year more on their car insurance.

The charity stress-tested the postcode findings and found that common risk factors of crime rate, deprivation, road traffic accidents and population density, could not account for the difference in price.

Citizens Advice is therefore calling this an ethnicity penalty.

Citizens Advice, which successfully campaigned to ban the loyalty penalty for insurance customers, is now calling on the Financial Conduct Authority (FCA) to ensure no one pays an ethnicity penalty in the insurance market.

The research

When Citizens Advice analysed the 18,000 car insurance costs, the findings showed a worrying trend. People of colour paid an average £250 more for car insurance regardless of gender, age, and income.

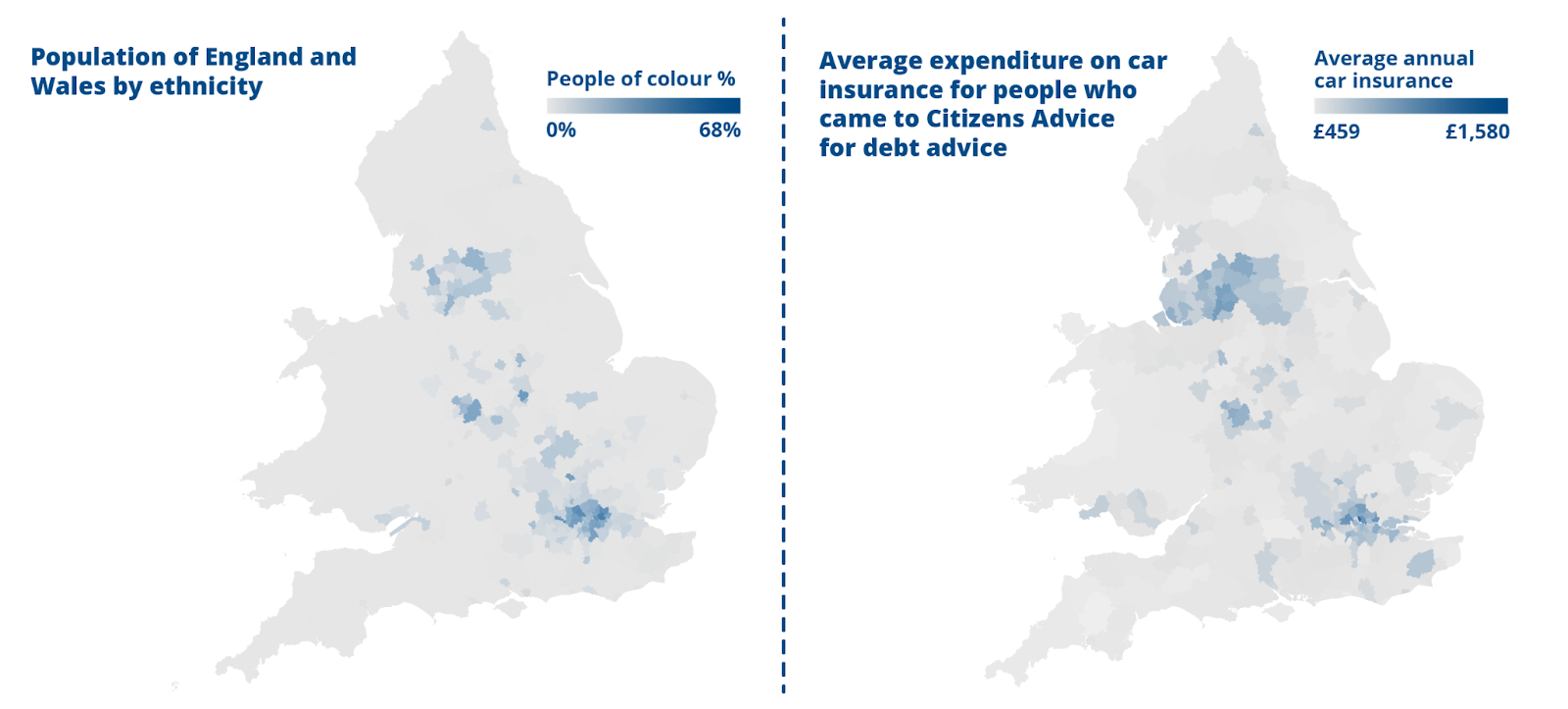

The heat maps below show a clear correlation between areas with a high proportion of people of colour, and higher car insurance costs.

The charity also carried out 649 mystery shops using six personas across eight postcodes. The majority of the personal details submitted online, including car, job and no claims history, remained the same.

In postcodes where over 50% of the population are people of colour, the charity found an ethnicity penalty of at least £280 a year. But this was even higher in areas with a higher proportion of people of colour.

The average quote in a low-crime area where most of the population were people of colour, was more than double that in a largely white area with a much higher crime rate.

What needs to happen next?

The FCA has a responsibility to ensure consumers are treated fairly across the markets it regulates, including insurance. In 2018 it warned insurers that using data linked to protected characteristics could discriminate against consumers.

Insurers don’t collect ethnicity data. But Citizens Advice fears the volume of data now available means there is a real risk that other data can be used as a proxy for the ethnicity of customers. This data is processed through complex algorithms which are hard to examine, making it difficult to track if some groups are paying more than others. This could be leading to the ethnicity penalty discovered through this research.

The charity is calling on the FCA to set out how insurance firms must prove they abide by the Equality Act 2010. It must also require insurance firms to audit and account for their pricing decisions. If the firm cannot explain any ethnicity pricing differences, the regulator must take enforcement action.

Dame Clare Moriarty, Chief Executive of Citizens Advice, said:

“For too long the impenetrable nature of insurance pricing has just been accepted, but a £280-a-year ethnicity penalty cannot be allowed to continue.

“It is time for the FCA to lift the bonnet on insurance firms’ pricing decisions and ensure no one is paying more because of protected characteristics like race.

“The use of algorithms has real-world implications for real people. They must be applied with caution, under the careful scrutiny of regulators.”

Notes to editors

18,000 people who came to Citizens Advice for help with debt completed a Budget Planner in 2021, and reported their car insurance costs. The Budget Planner is a detailed examination of the finances of someone in debt which considers their income, expenditure and any existing debts they hold.

Citizens Advice commissioned Europe Economics to carry out mystery shopping in Summer 2021. The research generated average quotes for different postcodes selected to represent areas with different ethnic compositions. Citizens Advice calculated the minimum difference between the quotes offered in predominantly white postcodes and the quotes offered in postcodes with a high proportion of people of colour. In order to calculate a conservative estimate for the ethnicity penalty it used the average price for the postcode with lowest % people of colour in the study. This gave the individual ethnicity penalty of £282.81.

Citizens Advice used ward level population data from the 2011 census to calculate the number of white people and people of colour living in diverse areas in England. 1,895,567 people of colour live in areas its research has shown are impacted by the ethnicity penalty in comparison to 844,578 white people. These figures were then used to calculate the percentage of white people and people of colour impacted by the ethnicity penalty based on the total population of white people and people of colour in England. We found that 26% of people of colour and 2% of white people live in areas impacted by the ethnicity penalty.

Citizens Advice used data from the FCA Financial Lives Survey 2020 to calculate the number of motor insurance policy holders, broken down by ethnicity. The total number of people of colour affected by the ethnicity penalty was multiplied by the individual ethnicity penalty to get the total ethnicity penalty of £213 million.

Citizens Advice analysed data from the eight mystery shopping postcodes to calculate the average car insurance costs for each of the postcodes that had over 85% white people, over 50% people of colour and over 85% people of colour.

The mystery shopping research tested two types of car. The cars selected are within the five the most commonly owned vehicles in the UK.

Citizens Advice submitted a super complaint on the loyalty penalty - in the mobile, broadband, home insurance, mortgages and savings markets - to the CMA in September 2018 calling for it to consider how the problem can be fixed. In May 2021 the FCA banned price walking - gradual year-on-year increases - for home and motor insurance.

Citizens Advice is made up of the national charity Citizens Advice; the network of independent local Citizens Advice charities across England and Wales; the Citizens Advice consumer service; and the Witness Service.

Our network of charities offers impartial advice online, over the phone, and in person, for free.

We helped 2.4 million people face to face, over the phone, by email and webchat in 2020-21. And we had 40 million visits to our website. For full service statistics see our monthly publication Advice trends.

Citizens Advice service staff are supported by more than 21,000 trained volunteers, working at over 2,600 service outlets across England and Wales.

You can get consumer advice from the Citizens Advice consumer service on 0808 223 1133 or 0808 223 1144 for Welsh language speakers.